Middle East War Drives USD Volatility — What It Means for the Naira

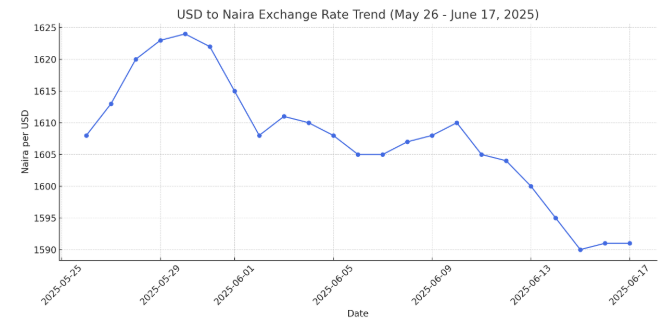

Date Range Analyzed: May 26 – June 17, 2025

Focus: How the Middle East conflict is strengthening the US dollar and weakening the Naira

Overview: How Conflict Fuels Dollar Strength

The recent escalation of military tensions in the Middle East has once again proven a timeless market truth: geopolitical instability boosts the US dollar. As global investors flee to safe-haven assets, the dollar index (DXY) has risen, and this has had direct consequences on emerging market currencies like the Nigerian Naira.

Between May 26 and June 17, 2025, the Naira depreciated steadily from ₦1,608 to ₦1,591 per USD, with sharp daily movements reflecting investor anxiety.

Day-by-Day Breakdown: What the Data Shows

Below is the visual representation of the USD/NGN closing rate trend over the period:

Key points from the data:

Peak exchange rate: ₦1,624 on May 30

Lowest point: ₦1,590 on June 15

Overall shift: ₦18 fluctuation in just over three weeks

Volatility markers: Rapid swings between uptrends and downtrends, with little stability

These fluctuations reflect the market’s reaction to uncertainty in the Middle East, especially surrounding oil supply chains, US foreign policy, and inflation hedges.

Why the Dollar Gains in Times of War

When war breaks out in oil-rich regions like the Middle East:

Oil prices spike — boosting the US energy sector and dollar demand

Investors rush to safety — reallocating funds into US Treasury bonds and dollar-denominated assets

Emerging markets lose capital — currencies like the Naira face outflows and pressure

As a result, we’re seeing renewed strength in the dollar and steady depreciation of the Naira, especially as Nigeria grapples with local inflation and trade imbalance.

Insights for Forex Traders and Investors

Short-term: Expect continued volatility as headlines shift daily. Caution is advised for speculative trades.

Medium-term: If the conflict escalates, dollar dominance could persist, especially if oil supplies are further disrupted.

Long-term: Watch for monetary policy updates from the US Fed and Nigeria’s CBN — any divergence could magnify the spread.

For investors in Nigeria, this is a critical time to:

Hedge exposure to the Naira

Explore dollar-backed assets

Track geopolitical developments closely

Conclusion: Safe Haven Rules Still Apply

Middle East War Drives USD Volatility despite decades of change in global economics, one truth remains constant: In times of war, the dollar wins. For Nigerians and forex traders, this means greater exposure to USD risk and opportunities — if you know where to look.